Sound cash rental decisions for landowners

Cash rate should not be the sole factor in cropland rental decisions.

What would be the cash rental rate for my farmland? This is a frequent question from landowners who call the Michigan State University Extension county offices for a quick answer. Different agencies carry out yearly surveys and estimated dollar figures are published. However, MSU Extension recommends landowners only use them as a guide because there are a few other considerations for making sound rental decisions.

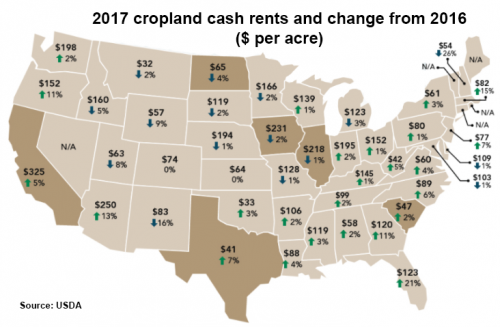

Cash rents can vary from year-to-year. According to USDA’s 2017 Cash Rents Survey, the national average for cropland cash rent is $136 per acre. This average was the same in 2016, but in 2015 the average rent peaked at $144 per acre. Michigan’s average cash rental value in 2017 was $123 per acre, down 3 percent from 2016 (Fig. 1). This declining trend in rental rate is largely attributed to the decline in net farm incomes.

Figure 1. 2017 cropland cash rents and change from 2016 ($ per acre). Source: USDA.

MSU’s Department of Agricultural, Food and Resource Economics does its own surveys and releases a yearly report, “Michigan Land Values and Leasing Rates Report No. 649.” In this report, field crop rental figures are published for irrigated versus non-irrigated and tilled versus non-tilled land on a county basis. Rates for sugarbeet and fruit tree land are also available for appropriate districts. Generally, counties in the east central and southern tier districts of Michigan garner the highest rental rates.

Because rental rates depend on a multitude of factors, landowners should try to stay abreast of the farm economy and be willing to negotiate with tenants. Iowa State University Extension economist Alejandro Plastina feels that understanding of the true financial situation of the tenant and the local industry is vital in 2018 cash rent discussions.

“Although we’re seeing a decline in cash rents, land values in Iowa are holding steady or increasing,” said Plastina. “That can be mistakenly interpreted as an improvement in the agriculture sector, but that’s not the case at all.”

Arriving at a fair cash rental rate in advance of each crop year may be difficult because of uncertainties in yield and grain prices. Another option may be to use flexible lease agreements in which the rent is determined after the crop is harvested. The final rental rate is based on actual prices or yields attained each year. More information on these agreements are available from the Iowa State University Extension publications, “Flexible Farm Lease Agreements, June 2017” and “Flexible Farm Lease Agreements, July 1999.”

Most farm management specialists agree landowners prefer continuity in a tenant. Consider how the tenant is currently managing the property in terms of crop rotations and conservation practices. Are the soils tested regularly and maintained at good fertility levels? Does this person share information about crop yields and cropping practices?

There are some risks, particularly the unknowns, in dealing with a new tenant. If someone is offering an exorbitantly high rental rate, that should warrant more inquiries and background checks. A local farmer with a good reputation, if available, may be worth considering at a reasonable rate.

The ability to communicate with the tenant on a regular basis is vital to avoid some of the most common owner-tenant issues. Building mutual trust will help to iron out situations that arise from unforeseen events.

For related articles, visit MSU Extension’s Farm Management website.

Print

Print Email

Email