Livestock gross margin insurance for dairy: Part 2

New LGM rules may make the program attractive to more producers.

In part 1 of this series we discussed the basic concepts of the LGM-Dairy program and gave an overview of the program’s rules and regulations. In part 2 we will consider an LGM-Dairy example that will illustrate many of the concepts introduced in part 1. Readers are encouraged to review part 1 before reading part 2.

LGM-Dairy Example

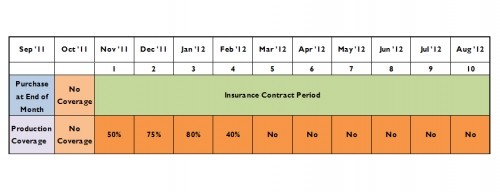

To better understand the rules of LGM-Dairy and how the program works we will consider an example. Let’s assume a producer is going to purchase a contract during the purchase period at the end of September 2011 (Figure 1). Poverty Acres Dairy consists of 500 cows averaging 25,200 pounds milk sold per cow per year. Using the software available at the University of Wisconsin’s Understanding Dairy Markets website feed usage was determined to be 170.4 tons of corn equivalent and 42.6 tons of soybean meal equivalent per month. Total monthly milk production was assumed to be evenly spread across all 12 months with 15% of the herd dry in any one month. This results in a total of 8,925 cwts of milk sold per month.

Let’s evaluate the gross margin guarantee (GMG) for the month of November 2011. Only 50% of targeted marketing were selected for coverage with a $1.00/cwt deductible. Expected milk price is $17.27/cwt, expected corn price is $7.08/bu and expected soybean meal price is $358.90/ton. Recall:

Expected Gross Margin (GM) = expected market value of milk minus expected feed costs

Then,

GM = (8,925 cwts milk X $17.27/cwt X 50% covered) minus 50% covered X (170.4 tons corn X $7.08/bu X 35.71 bu/ton + 42.6 tons soybean meal X $358.90/ton)

GM = $77,076 - $21,543 - $7,645

GM = $47,888

Now, the GMG must be calculated, recall:

Gross Margin Guarantee (GMG) = GM minus deductible

In our example we chose a deductible of $1.00/cwt; therefore,

GMG = $47,888 – (8,925 cwts milk X $1.00/cwt X 50% covered)

GMG = $47,888 - $4,463

GMG = $43,416

This same process is used to calculate the GMG’s for each month with targeted marketing. Recall that a potential indemnity payment exists when actual gross margain (AGM) < GMG, therefore, for November 2011 a potential indemnity payment would exist if the AGM for November 2011is less than $43,416. However, remember there are only one GMG and AGM per contract because contracts are evaluated over the entire contract period. Thus, the producer would have to wait until after the actual prices are available for the last month with targeted marketing (March 2011 in Figure 1) to know if the total AGM is less than total GMG.

Producers have options when it comes to premium billings and indemnity payments. In the month following the last month with targeted marketing (March 2011 in Figure 1) the producer may choose to receive an indemnity payment if it is due. If the total indemnity payment is less than the total premium, the net premium payment can be made at this time and no indemnity payment is received. Even if the producer owes a net premium payment they may still choose to receive the indemnity payment in the month following the last month with targeted marketing (March 2011 in Figure 1) and then wait to pay the entire premium the month following the last month in the contract period (September 2012 in Figure 1).

Producers must file a marketing report to receive an indemnity payment. This report must be filed within 15 days of a notice of a probable loss from their insurance agent. The marketing report must also be supported by milk sales receipts showing evidence of actual marketing in each month with targeted marketing. In the event total actual marketing are less than 75% of the total of targeted marketing for the insurance period, indemnities will be reduced by the percentage by which the total actual marketing for the insurance period fall below the total of target marketing for the period. There are no limits to milk production covered per year, but annual indemnities are limited to a maximum of 240,000 cwts.

The example contract period (Figure 1) would be available for purchase beginning from about 6:00 p.m. EDT on the last business Friday September 30 until 9:00 p.m. EDT the following day Saturday October 1. Figure 1 shows the LGM-Dairy insurance period extends for 10 months from November 2011 to August 2012. Program rules do not allow coverage in the month after purchase (i.e., October 2011). The producer does not have to insure each of the 10 months, but can vary the coverage to the months desired and also vary the percentage of milk production covered within the months with targeted marketing. In this example, only four months have covered, or targeted marketing (November and December 2011 and January and February 2012). Also, in the example the covered months are covered at less than 100% coverage. The producer in this example chose not to cover March through August 2012. Since LGM-Dairy contracts can be purchased every month, the producer in this example could choose to purchase coverage for the months without targeted marketing in the September contract using subsequent LGM-Dairy contracts in the following month(s).

When the rules of the LGM-Dairy program were changed during the first half of 2011, allowing premium payments to be made at the end of the insurance contract period, the program became very popular. Its popularity increased even more when market conditions in the spring of 2011 made LGM-Dairy a very attractive risk management tool. LGM-Dairy was allocated $16.2 million in underwriting capacity for fiscal year 2011 (October 1, 2010 through September 30, 2011) and that amount was exhausted during the March 2011 sales period. LGM-Dairy will not resume sales until the fiscal year 2012 begins in October 2011. With our nation’s budget woes, it remains to be seen how much and how long this program will be funded. Funding for FY-2012, beginning October 1, 2011, was only for $7 million, therefore, subsidized premiums will probably not be available for more than one or two months in FY-2012 (October 1, 2011 through September 30, 2012).

Conclusion

LGM-Dairy is a flexible insurance program all dairy producers should investigate. It guarantees a minimum IOFC by establishing a milk price floor (minimum) and feed (corn, SBM equivalents) cost ceiling (maximum). It does not require all milk production and feed usage to be insured, allows overlapping of contracts, contracts can be purchased every month for up to 10 months into the future and it provides substantial premium subsidies and a variable deductible. It is very similar to the bundled options strategy which employs milk put options and feed call options, but is much cheaper and more flexible in regards to amounts of milk and feed covered. Its major drawbacks are the short sign-up window, producers must wait for an indemnity payment for a given contract until the month following the last month with targeted marketing in that contract, and a subsidy in any given year disappears when program funds are exhausted prior to the end of a fiscal year.

Figure 1: LGM-Dairy insurance contract period for insurance purchased in the September 2011 sales period.

Print

Print Email

Email