Fertilizer prices on the rise

Farmers need to be aware of the volatility of fertilizer prices and understand their best options for purchasing fertilizer.

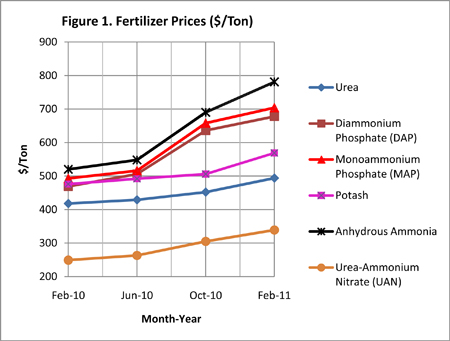

The February 2011 approximate retail prices for major fertilizers per ton are:

- $494 for Urea (53¢/lb N)

- $678 for Diammonium phosphate(DAP) (53¢/lb N+P2O5)

- $704 for Monoammonium phosphate(MAP) (56¢/lb N+ P2O5)

- $569 for Potash (47¢/lb K2O)

- $339 for Urea-Ammonium Nitrate (UAN 28%) (59¢/lb N)

- $781 for Anhydrous Ammonia (48¢/lb N).

Compared to a year ago, these figures reflect an increase per ton of $76 for Urea, $209 for DAP, $97 for MAP, $83 for Potash, $90 for UAN and $261 for anhydrous Ammonia.

We remember how fertilizer prices skyrocketed in late 2008 causing farmers to drastically cut down on their phosphate and potassium use. But those prices dropped dramatically in 2009. However as the following chart illustrates, the retail prices have substantially increased since the summer of 2010. Given the fact that fertilizer is the single biggest input cost for grain production, this unprecedented volatility in prices is a constant concern to producers.

Historically, when grain prices and natural gas prices increased, we would invariably see an increase in fertilizer prices. The prevailing high grain prices may well result in an increased acreage in 2011 posing additional demands on fertilizer. The unrest in the Middle East has impacted the export availability of nitrogen (N) fertilizers as Egypt is a major exporter of urea. Natural gas prices and N fertilizer prices were intricately connected because natural gas is a major ingredient of the Haber-Bosch process in the synthesis of anhydrous ammonia. About 33,500 cubic feet of natural gas is required to produce one ton of anhydrous ammonia. Most of the other popular forms of N fertilizers are made out of anhydrous ammonia. However, since the early 2000’s, natural gas prices in the United States have had little impact on nitrogen prices as we became a major nitrogen fertilizer importer.

The factors overseas such as the unrest in Egypt and China’s imposition of high fertilizer export tariffs have much more of an impact on nitrogen prices in the United States now than in the past. The major impact of low natural gas prices in the United States has been to keep the U.S. nitrogen fertilizer producers in business and profitable, at least the 60 percent of the industry that is left after the cutbacks in the early 2000’s.

A useful website to monitor fertilizer prices is http://www.ams.usda.gov/mnreports/gx_gr210.txt. This is a bi-monthly publication of the USDA-Illinois Dept. of Agriculture. Monitoring fertilizer price trends should help farmers to decide the best time to purchase fertilizer. Prepaying for fertilizer is a very desirable practice to avoid future price risks.

March 10 meeting: Fertilizer Outlook 2011 and Beyond

The important question is: Where are these prices heading? We will discuss the 2011 fertilizer outlook in more detail on March 10, at which time Mr. David Asbridge, President and Senior Economist of NPK Fertilizer Advisory Service based in St. Louis, Missouri, will be our main speaker. This event, Fertilizer Outlook 2011, will be held at the MSU Agronomy Farm from 10 AM to 3 PM (view meeting announcement for details). David will cover the global fertilizer situation and present fertilizer price forecasts for the next 4-6 months. Please call George Silva 517-543-2310 or email silvag@anr.msu.edu if you wish to attend this event.

*Data Sources: USDA- IL Dept. of Ag Market News and DTN.

Consider fertilizer alternatives

If synthetic fertilizer prices continue to increase, farmers may want to think about fertilizer alternatives, including the expanded use of animal waste products. Incorporating legumes and cover crops into crop rotation will reduce the dependence on synthetic fertilizer. Cover crops also help in carbon sequestration and reduce the so called “carbon footprint.” Another option would be to explore purchasing fertilizer in the off season and storing on farm. having storage capability expands fertilizer purchase options and help reduce total costs.

Slight modifications may work

I will be posting a follow-up article that will discuss temporary options for farmers to slightly modify the MSU fertilizer recommended rates without risking yield losses, particularly if major fertilizers become price prohibitive. Soil tests have indicated that about 70% of Michigan fields have adequate phosphorus levels. However, only 30% of the fields have adequate potassium levels. So returns to investment on potassium may be greater than on phosphorus fertilizer.

Print

Print Email

Email