Dairy market update, November 2013

Could Class III milk prices turn downward despite record U.S. dairy product exports?

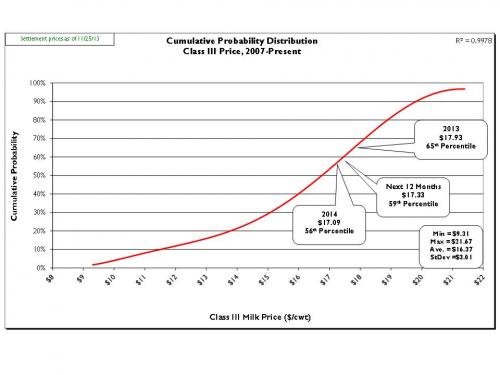

Prices: On Monday, Oct. 28, 2013, spot prices for cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) were $1.8750/lb. and $1.8200/lb., respectively. CME block and barrel cheese prices are up since late Sept. (9/27/13) +$0.1250/lb. and +$0.1000/lb., respectively. During the same time period, butter is down to $1.4750/lb. (-$0.1350/lb.). The CME Class III futures averages (10/28/13) for 2013 was up to $17.91/cwt. (+$0.18/cwt.), the next 12 months was up to $17.28/cwt. (+$0.26/cwt.), and 2014 was up to $16.95/cwt. (+$0.19/cwt.). These Class III futures averages correspond to potential USDA Michigan mailbox prices of $18.92/cwt. (2013), $18.29/cwt. (next 12 months), and $17.96/cwt. (2014). Figure 1 shows the current (10/28/13) CME Class III futures averages for 2013, the next 12-months, and 2014 are at the 66th, 59th, and 53rd percentiles, respectively.

Figure 1: Cumulative probability graph of USDA announced Class III prices (2007-present) and current CME Class III futures averages.

Supply: The Nov. USDA-NASS Milk Production Report showed Oct. U.S. milk production rose 1.0 percent nationwide as compared with Oct. 2012 which was below trend (+1.5 percent, 2007-2012). Oct. milk production in Michigan increased 2.7 percent compared with Oct. 2012. Cow numbers on the report showed U.S. dairy cow numbers at 9,202,000 head, up 13,000 head from Oct. 2012. Milk per cow was up only 0.8 percent as compared to Oct. 2012. The Oct. USDA-NASS Livestock Slaughter Report showed dairy cow slaughter down 8,600 head as compared with Oct. 2012, but the national cull rate was 36.1 percent which was well-above the Oct. average (+5.8 percentage points). Average cull cow prices remained strong in Oct. at $79.70/cwt. (+3.0 percent compared with Oct. 2012). The USDA reports a decrease in dairy feed prices in Oct. of 21.6 percent compared with Oct. 2012. The Oct. milk:feed ratio, at 2.09, was above 2.00 for the first time in thirty months (March, 2011).

Demand: Total commercial disappearance of dairy products for 2012 finished the year slightly below trend (+1.5 percent, 2007-2012) at +1.4 percent. So far for CY-2013 (Jan.-July) total commercial disappearance was down 0.2 percent. Feb.-June total commercial disappearance was a dismal -1.3 percent below Feb.-June 2012; however, July (+3.2 percent as compared with July 2012) set a new July record. The Jan.-July disappearance of individual dairy product categories was: American cheese, +2.9 percent; other cheese, +1.7 percent; nonfat dry milk, -22.0 percent; butter, +0.5 percent; and fluid milk, -2.3 percent (through Sept.) as compared with Jan.-July 2012.

U.S. dairy trade has shown trade surpluses for forty four consecutive months. Sept. U.S. dairy exports were valued at $592.9 million which was the sixth consecutive month U.S. dairy product exports exceeded $500 million. Sept. marked the thirtieth month out of the past thirty one in which exports exceeded $400 million and equaled 16.6 percent of total U.S. milk solids production. For CY-2013 (January-Sept.) U.S. dairy exports accounted for 56 percent of nonfat dry milk/skim milk powder produced in the U.S., 6.1 percent of cheese, 9.5 percent of butter; 56 percent of dry whey, and 75 percent of lactose.

Dairy Product Inventories: The Oct. edition of the USDA-NASS Cold Storage Report showed inventory increases for American cheese (+3.0 percent, 629.2 million pounds) and total cheese (+2.9 percent, 1,024.2 million pounds) as compared with Oct. 2012. Oct. marked the tenth consecutive month total cheese inventory was above 1.0 billion pounds. Oct. butter inventory was 19.8 percent above Oct. 2012 at 173.8 million pounds, marking the twenty sixth consecutive month butter inventory was above the same month last year.

Outlook: Cheese prices are on a weakening trend while butter prices remain strong. The Thanksgiving portion of the traditional fall holiday sales season is drawing to a close. Milk production remains below trend increases, however, slaughter rates appear to be declining. Producer margins are much healthier and feed prices promise to go even lower. Look for producers to push to produce more milk. Therefore, look for the national dairy herd to grow as we move into 2014. It is also possible lower feed prices will push milk per cow upward to near trend increases. Look for Class III prices to falter as we move into Dec. with Class III futures in Q-1 2014 dipping to the low $16/cwt. mark and even perhaps below $16/cwt.

There may remain a slight opportunity for a very, very short term rally in cheese, butter and Class III prices as the final dairy product sales for Christmas take place in early Dec. Producers should seriously consider covering a portion of their Q-1 2014 milk production if those short-lived rallies materialize and if they have not done much forward pricing of milk production.

International dairy product prices remain above U.S. domestic prices as world demand for dairy products remains healthy. Demand has been particularly bolstered by increased demand from China and Russia. The Oceania 2013-2014 production season is now past peak and milk production in Australia is running 3-4 percent below last year and New Zealand is running 4-5 percent above last year. It is reported that most of New Zealand’s milk production is being manufactured into powder with very limited cheese production. Therefore, experts expect hardly any New Zealand cheese available for export clearing the way for continued strong U.S. cheese exports. U.S. dairy exports will likely remain very strong well into 2014 if not longer. In the longer term lower feed prices are likely to fuel increased milk production both here in the U.S. and in the major dairy exporting regions around the globe clouding the longer term U.S. dairy export outlook.

Producers should sharpen their pencils, calculate their latest cost of production and look for pricing opportunities for both milk and feed. Class III prices may strengthen on short term rallies as wholesalers fill and feed the retail dairy product pipeline for the final push to the Christmas holiday. Pricing some milk now for the first quarter of 2014 is particularly import as Class III prices will likely drop close to, or even below, $16/cwt for that time period. Some bearish signs are on the horizon as U.S. dairy producers are likely to gear up production given more favorable profit margins. However, the strong export market should prevent any major crash of U.S. milk prices. Michigan State University Extension reminds producers that marketing is first about price risk management and secondarily about profit enhancement. Work at increasing your overall average milk price rather than trying to hit the market high.

The new Farm Bill remains in a state of limbo. There is now talk of extending the old Farm Bill for two years. Very few legislative days remain until the Christmas recess so this scenario is looking more and more likely.

The Nov. USDA Milk Supply and Demand Estimates report forecasted 2013 milk production down slightly at 201.7 B pounds (+0.7 percent vs. 2012) and forecasted fat basis commercial disappearance down at 193.1 B pounds (-0.1 percent vs. 2012). Forecasted 2013 wholesale dairy product and milk class prices were mostly up in the USDA’s 2013 forecast for Nov.

Print

Print Email

Email