Dairy market update, June 2013

Dairy market fundamentals are increasingly bearish in the near term but bullish in the longer term.

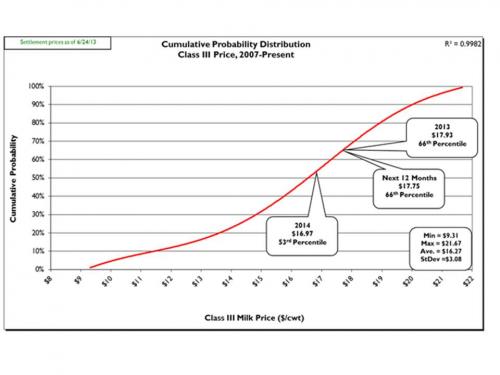

Prices: On Monday, June 24, 2013 spot prices for cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) were $1.6875/lb. and $1.6775/lb., respectively. CME block and barrel cheese prices are down since late May (5/28/13) -$0.0675/lb. and -$0.0450/lb., respectively During the same time period, butter is down to $1.4750/lb. (-$0.0700lb.). The CME Class III futures averages (6/24/13) for 2013 was down to $17.93/cwt. (-$0.20/cwt.), the next 12-months was down to $17.75/cwt. (-$0.31/cwt.), and 2014 was up to $16.97/cwt. (+$0.04/cwt.). These Class III futures averages correspond to potential USDA Michigan mailbox prices of $18.94/cwt. (2013), $18.77/cwt. (next 12-months), and $17.98/cwt. (2014). Figure 1 shows the current (6/24/13) CME Class III futures averages for 2013, the next 12-months, and 2014 are at the 66th, 66th, and 53rd percentiles, respectively.

Figure 1: Cumulative probability graph of USDA announced Class III prices (2007-present) and current CME Class III futures averages.

Supply: In May U.S. milk production rose 0.8 percent as compared with May 2012. This was obviously below trend increase (+1.6 percent, 2007-2012) and marked the eleventh time in the past 12 months milk production grew below trend. May production in Michigan increased 2.5 percent compared with May 2012. Due to “sequestration” budget cuts NASS did not report dairy cow numbers or milk per cow for May. However, dairy cow slaughter in May was down 3,600 head as compared to May 2012. Thus, it is probable the U.S. dairy herd grew in May. Average cull cow prices have softened a bit, but remain historically high at $80.10/cwt. (-8.7 percent compared with May 2012). The USDA reports an increase in dairy feed prices in May of +5.6 percent compared with May 2012. The May milk:feed ratio, at 1.47, was below 2.00 for the 28th time in the past 30 months.

Demand: Total commercial disappearance of dairy products for 2012 finished the year slightly below trend (+1.5 percent, 2007-2012) at +1.4 percent. So far for CY-2013 (January-March) total commercial disappearance was down 0.6 percent. February-March total commercial disappearance was a dismal -1.9 percent below February-March 2012. The January-March disappearance of individual dairy product categories was: American cheese, -0.1 percent; other cheese, +0.1 percent; nonfat dry milk, -15.0 percent; butter, +5.5 percent; and fluid milk, -2.3 percent (through April) as compared with January-March 2012.

U.S. dairy trade has shown trade surpluses for thirty nine consecutive months. April U.S. dairy exports were valued at $558.8 million, an all-time monthly record and up 20.4 percent from April 2012. April marked the twenty fifth month out of the past twenty six in which exports exceeded $400 million and equaled 15.7 percent of total U.S. milk solids production. For CY-2013 (January-April) U.S. dairy exports accounted for 46 percent of nonfat dry milk/skim milk powder produced in the U.S., 5.7 percent of cheese, 5.8 percent of butter; 48 percent of dry whey, and 72 percent of lactose.

Dairy Product Inventories: The latest USDA Cold Storage Report showed inventory increases in May for American cheese (+10.1 percent, 717.9 million pounds) and total cheese (+8.2 percent, 1,156.7 million pounds) as compared with May 2012. Both inventories were records for the month of May as well as all-time highs. May marked the sixth consecutive month total cheese inventory was above 1.0 billion pounds. May butter inventory was 23.5 percent above May 2012 at 323.7 million pounds, marking the twenty second consecutive month butter inventory was above the same month last year and setting an all-time record for butter inventory.

Outlook: Despite continued below trend growth in U.S. milk production dairy market fundamentals remain on the bearish side. NASS no longer reports cow numbers, at least for the remainder of FY-2013 (Sep), therefore considering May dairy cow slaughter numbers were down 3,600 head compared with May 2012 one would suspect the U.S. dairy herd is growing again. Dairy producer margins are much better than this time last year encouraging dairy producers across the country to increase milk output in the coming months. Anecdotal reports support such a conclusion as both cheese plants and butter churns are running at, or near, full capacity across the country.

In the longer term, many expect the U.S. dairy industry to contract even in the face of healthy margins. Beef prices remain very strong and promise to strengthen further as steers are bringing in more dollars than dairy replacement heifers, and crossbred calves are more valuable than purebreds. Many are reporting sexed semen usage is down and some Holstein heifers have been sold at auctions in lots destined for the feedlot. Many believe this trend will continue pulling dairy animals to beef and eventually begin a noticeable shrinkage of the U.S. dairy herd.

Inventories of cheese and butter are at all-time historical highs as we finish June the final month of the traditional “spring flush” of milk output. However, anecdotal reports, such as USDA Dairy Market News (6/21/13), says such inventory levels “are not felt to be problematic.” I hope they are right, but in my mind the dramatic increase in cheese inventories does not bode well for strong summer cheese prices which are usually the norm.

International dairy product prices, though high, have softened a bit recently. However, world demand for dairy products remains healthy and the USDEC estimates the top five dairy exporting regions (New Zealand, EU, U.S., Australia and Argentina) will be down over 1.0 percent in combined milk production for the first half of 2013 which is a shortfall of 1.6 million tons of milk compared to last year. Oceania has ended their 2012-2013 production season and reports stocks of finished products are only adequate for servicing existing accounts with little extra for other demand. A similar situation exists in the EU. Thus, U.S. dairy exports should remain strong as our domestic prices are below international prices. Amazingly, April U.S. dairy exports set an all-time monthly record at $558.8 M and represented a whopping 15.7 percent of U.S. milk production on a total solids basis. However, domestic consumption is in the doldrums down 0.6 percent January-March (compared to January-March 2012) despite January total commercial disappearance setting an all-time January record. The U.S. dollar is off its recent high which should bolster the already very strong export market.

USDA measured feed prices were higher in May than last year (+5.6 percent as compared to May 2012). However, on the CME corn and soybean meal futures prices for this fall are about 10-20 percent lower than 2012 showing promise of lower feed costs in the future. But, forage prices continue at historical highs due to 2012 weather problems, extensive winterkill of alfalfa and very low hay acres. The USDA reported the U.S. average alfalfa hay price was at $221/ton for May, which I believe is an all-time high. A recent USDA report showed nationwide alfalfa/alfalfa mixed hay production down 15.0 percent (Michigan was down 17.5 percent); the lowest production since 1953 and hay acreages are the second lowest on record. Further USDA reports indicate hay stocks are down about 34 percent vs. May 2012, with some states reporting declines of 50 percent or more (e.g., MI, MN, NY, OH, VT and WI). Much of these declines are due to planting decisions and are unlikely to change the hay outlook very soon. There are also reports of about 1.75 to 2.00 million acres of alfalfa being lost in the upper Midwest due to higher than normal winterkill. Overall hay production this year is very likely to be quite short causing further price increases and limited availability. If you are short of hay or haylage you had better being scouring the countryside now! Michigan State University Extension maintains a free hay sellers website.

Earlier this spring I was very confident dairy product prices would be stronger this summer. However, the recent downturn in dairy cow slaughter and dramatic increase in cheese inventories has put a real damper on prices. In the short term I would hope to see some strengthening of dairy prices as we move into mid-July and the spring flush is behind us. Currently the biggest problem is domestic consumption. Hopefully stronger consumer confidence will salvage the summer vacation season spurring domestic dairy consumption. Strong international dairy prices, declining milk production in the five major dairy exporting nations and continued healthy international demand for dairy products should provide good support to keep U.S. milk prices from crashing as we move into summer and fall. So far there do not appear to be any major heat waves or droughts that will seriously impact milk production or crop growth. Hopefully there will be some better milk pricing opportunities moving into July and August as compared to current market conditions. However, will the huge cheese inventories prove to be the “sword of Damocles” hanging over higher prices?

Producers should sharpen their pencils, calculate their latest cost of production and look for pricing opportunities for both milk and feed. I am no longer optimistic we’ll see much $20 Class III milk this summer. If the futures market does reach that level it would be wise not to hesitate hoping for even higher prices. Milk prices in the $20 or higher range are very difficult to sustain and I think it will be especially true this year given our cheese inventory situation. So, don’t let the “greed” stage of the “greed, hope and fear” cycle overly influence your pricing decisions. Look for milk production to approach, and perhaps even surpass, trend increases as favorable margins stimulate production. Remember: marketing is first about price risk management and secondarily about profit enhancement. Work at increasing your overall average milk price rather than trying to hit the market high. A narrated PowerPoint based on this report is available.

Print

Print Email

Email