Dairy market update, July 2013

Dairy market fundamentals are increasingly bearish in the near term and Class III prices may decline even further this fall.

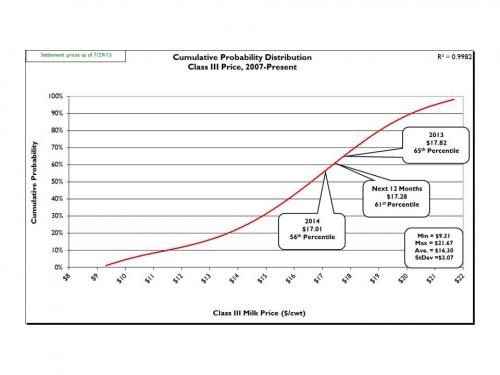

Prices: On Monday, July 29, 2013 spot prices for cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) were $1.7625/lb. and $1.7600/lb., respectively. CME block and barrel cheese prices are up since late June (6/29/13) +$0.0750/lb. and +$0.0825/lb., respectively. During the same time period, butter is down to $1.4300/lb. (-$0.0450/lb.). The CME Class III futures averages (7/29/13) for 2013 was down to $17.82/cwt. (-$0.11/cwt.), the next 12 months was down to $17.28/cwt. (-$0.47/cwt.), and 2014 was up to $17.01/cwt. (+$0.04/cwt.). These Class III futures averages correspond to potential USDA Michigan mailbox prices of $18.83/cwt. (2013), $18.30/cwt. (next 12 months), and $18.02/cwt. (2014). Figure 1 shows the current (7/29/13) CME Class III futures averages for 2013, the next 12 months, and 2014 are at the 65th, 61st, and 56th percentiles, respectively.

Figure 1: Cumulative probability graph of USDA announced Class III prices (2007-present) and current CME Class III futures averages.

Supply: In June U.S. milk production rose 1.6 percent as compared with June 2012 which was above trend (+1.5 percent, 2007-2012) for the first time in eleven months. June production in Michigan increased 3.7 percent compared with June 2012. Due to sequestration budget cuts, NASS did not report dairy cow numbers or milk per cow for June. However, dairy cow slaughter in June was down 8,900 head as compared to June 2012. Thus, it is probable the U.S. dairy herd grew in June. Average cull cow prices have softened a bit, but remain historically high at $80.10/cwt. (-6.9 percent compared with June 2012). The USDA reports an increase in dairy feed prices in June of +9.7 percent compared with June 2012. The June milk:feed ratio, at 1.53, was below 2.00 for the 29th time in the past 31 months.

Demand: Total commercial disappearance of dairy products for 2012 finished the year slightly below trend (+1.5 percent, 2007-2012) at +1.4 percent. So far for CY-2013 (January-April) total commercial disappearance was down 0.5 percent. February-April total commercial disappearance was a dismal -1.4 percent below February-April 2012. The January-April disappearance of individual dairy product categories was: American cheese, +0.9 percent; other cheese, +1.9 percent; nonfat dry milk, -9.1 percent; butter, +2.1 percent; and fluid milk, -2.1 percent (through May) as compared with January-April 2012.

U.S. dairy trade has shown trade surpluses for thirty nine consecutive months. May U.S. dairy exports were valued at $631.0 million, an all-time monthly record and up 25.4 percent from May 2012. May marked the twenty sixth month out of the past twenty seven in which exports exceeded $400 million and equaled 16.9 percent of total U.S. milk solids production. For CY-2013 (January-May) U.S. dairy exports accounted for 48 percent of nonfat dry milk/skim milk powder produced in the U.S., 5.9 percent of cheese, 6.2 percent of butter; 51 percent of dry whey, and 74 percent of lactose.

Dairy Product Inventories: The latest "USDA Cold Storage Report" showed inventory increases in June for American cheese (+6.5 percent, 705.2 million pounds) and total cheese (+4.9 percent, 1,148.7 million pounds) as compared with June 2012. Both inventories were records for the month of June as well as all-time highs. June marked the seventh consecutive month total cheese inventory was above 1.0 billion pounds. June butter inventory was 33.2 percent above June 2012 at 324.1 million pounds, marking the twenty third consecutive month butter inventory was above the same month last year and setting an all-time record for butter inventory.

Outlook: Dairy market fundamentals remain on the bearish side. NASS no longer reports cow numbers, at least for the remainder of FY-2013 (through September), therefore considering June dairy cow slaughter numbers were down 8,900 head versus June 2012 one would suspect the U.S. dairy herd is growing. The U.S. dairy herd must also certainly be getting younger due to the fact that since the beginning of 2011 297,900 more dairy cows have been slaughtered compared to the same month the previous year. Dairy producer margins are much better than this time last year encouraging dairy producers across the country to increase milk output. This upward trend in milk output may gain even more steam this fall if corn and soybean prices moderate as many expect. The typical summer slump in milk components is upon us, but cheese and butter inventories remain at record levels. However, anecdotal reports, such as "USDA Dairy Market News" (6/21/13), say such inventory levels “are not felt to be problematic.” I hope they are right, but in my mind the dramatic increase in cheese inventories does not bode well to support strong summer cheese prices which are usually the norm.

International dairy product prices remain above U.S. domestic prices and world demand for dairy products remains healthy. Milk production in the top five dairy exporting regions (New Zealand, EU, U.S., Australia and Argentina) was down a combined 2.4 percent January-April versus January-April 2012. Oceania will begin its 2013-2014 production season in August and reports still indicate finished product stocks are only adequate for servicing existing accounts with little extra for other demand. A similar situation exists in the EU with their milk output is expected to grow at less than 1.0 percent. Thus, U.S. dairy exports should remain strong as long as our domestic prices remain below international prices. Amazingly, April U.S. dairy exports set an all-time monthly record at $558.8 million and represented a whopping 15.7 percent of U.S. milk production on a total solids basis only to be totally blown out of the water with May exports at $631.0 million and 16.9 percent of U.S. milk solids production. However, domestic consumption remains poor being down 0.5 percent January-April (versus January-April 2012) despite January total commercial disappearance setting an all-time January record. The U.S. dollar is off its recent highs which should bolster the already very strong export market.

USDA measured feed prices were higher in June than last year (+9.7 percent as compared to June 2012). However, the CME is predicting corn under $5/bushel and soybean meal under $370/ton post-harvest this fall. Forage prices have moderated only slightly and will likely be above historical highs for the foreseeable future.

Earlier this spring I was very confident dairy product prices would be strong this summer. However, the recent downturn in dairy cow slaughter, sluggish domestic dairy consumption and dramatic increase in cheese inventories has put a real damper on my enthusiasm. In the short term, I would hope to see some strengthening of dairy prices as we move into August as components reach their usual summertime low. Domestic consumption remains the industry’s biggest headache. Hopefully stronger consumer confidence (up to 81.4 in June versus 74.3 in May) will salvage the latter half of the summer vacation season spurring domestic dairy consumption. The restaurant performance index (RPI) was at 101.8 in May providing some support for this hope. Strong international dairy prices, declining milk production in the five major dairy exporting nations and continued healthy international demand for dairy products will provide some support for U.S. milk prices as we move into late summer and fall. So far there do not appear to be any major heat waves or droughts that will seriously impact milk production or crop growth this year as it did last year. Hopefully there will be some better milk pricing opportunities moving into August as compared to current market conditions. However, will the huge cheese inventories prove to be the “sword of Damocles” hanging over higher prices? Also, the decline in culling and younger national dairy herd, when combined with expected lower corn and soy prices post-harvest, may fuel a major uptrend in U.S. milk production as we move into fall.

Producers should sharpen their pencils, calculate their latest cost of production and look for pricing opportunities for both milk and feed. I am no longer optimistic we’ll see any $20 Class III milk this summer or fall. Class III prices may erode further as we move into fall if my prediction about increased U.S. milk production proves true. If so, don’t be surprised to see $17 or lower Class III for the last quarter of 2013. Don’t let the “hope” stage of the “greed, hope and fear” cycle overly influence your pricing decisions. June milk production was above trend increase and promises to continue growing at such rates into 2014 as a host of factors support higher production. Remember: marketing is first about price risk management and secondarily about profit enhancement. Michigan State University Extension recommends that you work at increasing your overall average milk price rather than trying to hit the market high. A narrated PowerPoint based on this report is available here.

Print

Print Email

Email