Dairy Market Update, January 2012

Dairy fundamentals point to a weaker market with downside price risk.

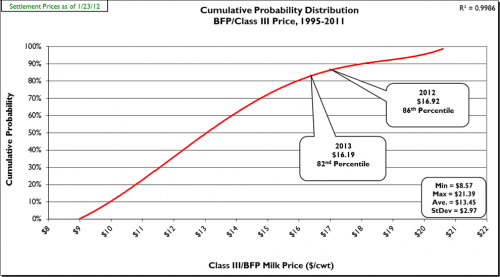

Prices: On Monday, Jan. 23, 2012, spot prices for cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) were $1.5050/lb and $1.4850/lb, respectively. CME block and barrel cheese prices are down since mid-December (12/12/11), -$0.1300/lb and -$0.0875/lb, respectively. The block/barrel average is below $1.50/lb for the first time since 1/13/11. During the same time period, butter is down (-$0.0550/lb) to $1.5650. The CME Class III futures average (1/23/12) for 2012 was down (-$0.19/cwt) to $16.92/cwt, while 2013 was up (+$0.12/cwt) to $16.19/cwt. These Class III futures averages correspond to potential USDA Michigan mailbox prices for 2012 and 2013 of $17.91/cwt and $17.18/cwt, respectively. Figure 1 shows the current (1/23/12) CME Class III futures averages for 2012 and 2013 are at the 86th and 82nd percentiles,

Supply: In December U.S. milk production increased above trend (+1.6%, 1995-2010) at +2.5% compared to December 2010 (+2.7% in Top 23 dairy states). December was the fifth consecutive month milk production grew above trend increase. December production in Michigan increased 4.2% compared to December 2010. The size of the U.S. dairy herd grew by 12,000 head from November to December and is up 80,000 head versus December 2010. Dairy cow slaughter numbers in 2011 ran well ahead of last year, up 106,600 head. Average U.S. cull cow prices are softening, but remain historically very high in December at $69.00/cwt (+25.2% compared to December 2010). Milk production per cow in 2011 was below trend increase (+0.8%), however, it has rebounded nicely from the July heat-induced decline and in December grew at trend rate for the first time in a year. USDA reported an increase in dairy feed prices in December of +24.9% compared with December 2010. December’s income over feed cost was up 14.5% (+$0.97/cwt) as compared with December 2010.

Demand: USDA reports total commercial disappearance in 2010 increased over 2009 (+3.3%), well-above the 1995-2009 average increase (+1.6%). All categories of wholesale dairy products showed above trend increases for 2010 except fluid products. Total commercial disappearance for 2011 started the year strong, but has weakened over the past five months and is now below trend increase (+1.1%) through September. All-time monthly records were set for January, February, March, and April; but May through September was down 0.8% compared to May through August 2010 despite September setting another all-time September record. January through September disappearance of individual product categories was: American cheese, +0.7%; other cheese, +4.5%; nonfat dry milk, -3.6%; butter, +10.0%; and fluid milk, -1.5%.

U.S. dairy exports were strong in calendar year 2011 (Jan-Nov) with exports valued at a record $4.012 billion (+29% as compared with Jan-Nov 2010) with a dairy trade surplus of over $1.66 billion. Calendar year 2011 (Jan-Nov) exports were equivalent to 13.3% of total U.S. milk solids production as compared to 12.7% for the same period in 2010. Imports for calendar year 2011 were equivalent to 2.8% of total U.S. milk solids production (lowest since 1996). November dairy exports equaled 14.1% of total U.S. milk solids production up from 13.3% in November 2010. In the first eleven months of calendar year 2011 (Jan-Nov) exports accounted for 50% of NFDM/SMP produced in the U.S., 4.6% of cheese, and 8.0% of butter.

Dairy Product Inventories: The latest USDA Cold Storage Report showed inventory decreases in December for American cheese (-4.8% at 600.7 million lbs.) and total cheese (-6.4% at 981.3 million lbs.) compared to December 2010. American cheese inventories set all-time monthly highs for each of the months from January through May, and July and August. Total cheese inventory set all-time monthly highs for every month January through August. December butter inventory was 28.7% above December 2010 at 105.2 million pounds, marking the fifth consecutive month butter inventory was above the same month last year.

Outlook: The normal fall holiday dairy product sales season has come to a close. Commercial disappearance figures for November and December are not yet available. However, American cheese inventory November to December grew at the highest rate in six years indicating holiday cheese sales were lackluster. The recent decline in cheese prices is normal as historically cheese prices hit their low for the year in January and February. The CME block/barrel cheese price peaked this fall at $2.0250/lb on 11/15/11 and has dropped $0.5300/lb to $1.4950/lb on 1/23/11. This is the first time the block/barrel average has been below $1.5000/lb since 1/13/11. CME Class III futures average for 2012 peaked on 1/11/11 at $17.4533/cwt and has fallen $0.5383/cwt to settle at $16.92/cwt on 1/23/11. Look for cheese prices in the low $1.50 range in the coming weeks. There still remains a possibility for cheese prices to slump to the mid $1.40’s. Dry whey prices remain high with February futures over $0.70/lb. At this level dry whey is boosting current Class III prices about $1.50/cwt over the first half of 2011. However, the average dry whey futures price for the second half of 2012 is only $0.49/lb. If these dry whey prices are realized the Class III price will fall $1.32/cwt simply do to the fall in dry whey price. I’m not sure the Class III futures market has accounted for this factor entirely. Therefore, I see good opportunities for locking in some 2012 milk at current futures prices.

The export market remains very strong and there is some indication of improvement in domestic consumer confidence. Hopefully this will translate into stronger domestic consumption in 2012. However, a great deal of risk remains in the market as U.S. milk production has grown at or above trend for the past five consecutive months. Also, the U.S. economy remains fragile and economic problems continue to overshadow economies in the European Union and economic growth in China and other Asian countries remains below earlier expectations. We must remember that the U.S. dairy industry in very dependent upon the fact that over 13% of our total milk solids production is going into the export market. Any shock to our export market that would even shave just a couple of percentage points off our exports could have a very negative effect upon domestic milk prices. The fiscal year 2012 export outlook is mixed with the USDA is forecasting a 13.3% decline while other dairy export industry exports are predicting an increase. As expected the Livestock Gross Margin-Dairy insurance funds were depleted very quickly in October and November and without an unexpected move from Congress LGM-Dairy will not be available again until late October 2012.

Given these price forecasts and risk factors in the market, dairy producers would be well advised to consider pricing 25-40% of their 2012 milk production. Corn and soybean meal prices have increased since early December, therefore, if you are a dairy producer forward pricing milk be sure to simultaneously lock in some feed. It is possible that feed prices might drop, but I believe there is much more upside than downside risk for feed prices.

Print

Print Email

Email