Dairy market update, August 2013

Dairy market fundamentals are increasingly bearish in the near term and Class III prices may decline even further this fall.

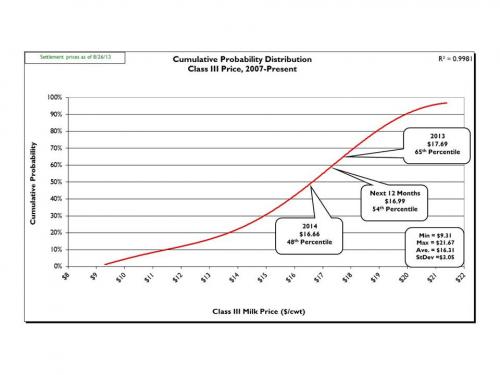

Prices: On Monday, August 26, 2013 spot prices for cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) were $1.6950/lb. and $1.7050/lb., respectively. CME block and barrel cheese prices are down since late July (7/29/13) -$0.0675/lb. and -$0.0550/lb., respectively. During the same time period, butter is down to $1.3950/lb. (-$0.0350/lb.). The CME Class III futures averages (8/26/13) for 2013 was down to $17.69/cwt. (-$0.12/cwt.), the next 12-months was down to $16.99/cwt. (-$0.30/cwt.), and 2014 was down to $16.66/cwt. (-$0.35/cwt.). These Class III futures averages correspond to potential USDA Michigan mailbox prices of $18.71/cwt. (2013), $18.00/cwt. (next 12-months), and $17.67/cwt. (2014). Figure 1 shows the current (8/26/13) CME Class III futures averages for 2013, the next 12-months, and 2014 are at the 65th, 54th, and 48th percentiles, respectively.

Figure 1: Cumulative probability graph of USDA announced Class III prices

(2007-present) and current CME Class III futures averages.

Supply: In July U.S. milk production rose 1.1 percent as compared with July 2012 which was below trend (+1.5 percent, 2007-2012). July production in Michigan increased 3.1 percent compared with July 2012. Due to “sequestration” budget cuts NASS did not report dairy cow numbers or milk per cow for July. Dairy cow slaughter in July was up 11,700 head as compared to July 2012. However, it is very likely the U.S. dairy herd at least remained stable in July. Average cull cow prices have softened a bit, but remain historically high at $80.90/cwt. (-1.1 percent compared with July 2012). The USDA reports an decrease in dairy feed prices in July of 0.5 percent compared with July 2012. The July milk:feed ratio, at 1.52, was below 2.00 for the thirtieth time in the past 32 months.

Demand: Total commercial disappearance of dairy products for 2012 finished the year slightly below trend (+1.5 percent, 2007-2012) at +1.4 percent. So far for CY-2013 (January-May) total commercial disappearance was down 0.7 percent. February-May total commercial disappearance was a dismal -1.4 percent below February-May 2012. The January-May disappearance of individual dairy product categories was: American cheese, +1.2 percent; other cheese, +1.5 percent; nonfat dry milk, -15.3 percent; butter, +1.0 percent; and fluid milk, -2.7 percent (through June) as compared with January-May 2012.

U.S. dairy trade has shown trade surpluses for 41 consecutive months. June U.S. dairy exports were valued at $596 million, an all-time June record and up 35.5 percent from June 2012. June marked the twenty-seventh month out of the past 28 in which exports exceeded $400 million and equaled 16.5 percent of total U.S. milk solids production. For CY-2013 (January-June) U.S. dairy exports accounted for 50 percent of nonfat dry milk/skim milk powder produced in the U.S., 5.9 percent of cheese, 7 percent of butter; 52 percent of dry whey, and 74 percent of lactose.

Dairy Product Inventories: The latest USDA Cold Storage Report showed inventory increases in July for American cheese (+5.0 percent, 704.5 million pounds) and total cheese (+5.4 percent, 1,152.1 million pounds) as compared with July 2012. Both inventories were records for the month of July and total cheese set an all-time high. July marked the eighth consecutive month total cheese inventory was above 1.0 billion pounds. July butter inventory was 26.2 percent above July 2012 at 295.8 million pounds, marking the twenty fourth consecutive month butter inventory was above the same month last year and setting an all-time July record for butter inventory.

Outlook: Dairy market fundamentals continue to trend on the bearish side. NASS no longer reports cow numbers, at least for the remainder of FY-2013 (through September), therefore no one really knows if the national herd is growing or declining. My suspicion is that it is at least stable and perhaps growing slowly based on healthier producer margins so far in 2013. Also, milk output is being boosted since the U.S. dairy herd is certainly getting younger due to the fact that since the beginning of 2011 349,600 more dairy cows have been slaughtered compared to the same month the previous year. Dairy producer margins are much better than this time last year (+27.8 percent higher IOFC) encouraging dairy producers across the country to increase milk output. This upward trend in milk output may gain even more steam this fall as feed prices in December, using the USDA formula, are forecasted to drop 16 percent (-$2.02/cwt. of 16 percent protein dairy feed) as compared with December 2012. Class I sales are picking up as schools are beginning the new school year and cooler fall weather is right around the corner so component levels will be recovering. Cheese and butter wholesalers are looking to replenish stocks given the current low prices as they prepare for the fall holiday sales season. However, cheese and butter inventories remain at record levels and promise to remain so until, and if, a brisk fall holiday sales season is experienced in 2013.

International dairy product prices remain above U.S. domestic prices and world demand for dairy products remains healthy. Oceania has begun its 2013-2014 production season which will peak in October. However, reports still indicate finished product stocks are only adequate for servicing existing accounts with little extra for other demand. A similar situation exists in the EU with EU milk output expected to grow at less than +1.0 percent. Two cases of tainted dairy products exported from New Zealand to China have taken some of the luster off Oceania’s reputation for top quality products. Thus, U.S. dairy exports should remain strong as long as our domestic prices remain below international prices, which looks virtually certain at this point. U.S. dairy exports are on an absolute tear with May and June both topping 16 percent of U.S. milk production on a total solids basis and year-to-date at 14.7 percent. However, domestic consumption remains poor being with total commercial disappearance down 0.7 percent January-May despite record exports. The U.S. dollar is off its recent highs which should bolster the already very strong export market.

Earlier this spring I was very confident dairy product prices would be strong this summer. However, stronger producer margins, higher milk production, sluggish domestic dairy consumption and record cheese and butter inventories has put a real damper on my enthusiasm. In the short term I expect prices to continue to slowly erode until the fall holiday sales season gets into full swing in October and early November. Even then prices may not recover recent losses if the fall holiday sales seasons parallels current domestic consumption trends. Undoubtedly domestic consumption remains the industry’s biggest headache. Also, consumer confidence slipped in July (down1.8 points from June) further dimming hope of stronger domestic dairy sales.

U.S. dairy exports promise to remain very strong at least through the end of this year, which is really the only bright spot for the industry and the only reason milk prices have not totally crashed. Look for U.S. milk production to grow at or above trend as we move into 2014 as lower feed prices will fuel greater output. The only hope I see – and it is only a small glimmer – is for a robust fall and holiday dairy product sales season. If that does not materialize we will look back at 2013 as a year with decent prices in the first half and poor prices in the second half.

Producers should sharpen their pencils, calculate their latest cost of production and look for pricing opportunities for both milk and feed. Class III prices may erode further as we move into fall. If so, don’t be surprised to see the CME Class III average for Q-4 2013 in the $16.80 range. Remember: marketing is first about price risk management and secondarily about profit enhancement. Michigan State University Extension recommends working on increasing your overall average milk price rather than trying to hit the market high.

Print

Print Email

Email