Dairy Market Update, April 2012

Dairy fundamentals weaken further increasing downside price risk.

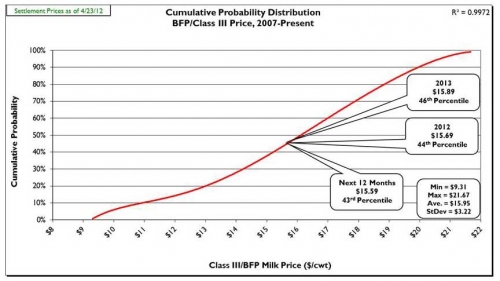

Prices: On Tuesday, April 23, 2012, spot prices for cheddar cheese blocks and barrels at the Chicago Mercantile Exchange (CME) were $1.5225/lb and $1.4700/lb, respectively. CME block and barrel cheese prices are up since late March (3/27/12), +$0.0325/lb and +$0.0100/lb, respectively. During the same time period, butter is down (-$0.1100/lb) to $1.4125/lb. The CME Class III futures average (4/23/12) for 2012 was down (-$0.45/cwt) to $15.69, the next 12 months was down (-$0.47/cwt) to $15.59/cwt, and 2013 was down (-$0.20/cwt) to $15.89/cwt. These Class III futures averages correspond to potential USDA Michigan mailbox prices for 2012, the next 12-months and 2013 of $16.68/cwt, $16.58/cwt and $16.88/cwt, respectively. Figure 1 shows the current (4/23/12) CME Class III futures averages for 2012, the next 12-months and 2013 are at the 44th, 43rd and 46th percentiles, respectively.

Figure 1: Cumulative probability graph of USDA announced Class III prices (2007-present) and current CME Class III futures averages.

Supply: In March U.S. milk production increased above trend (+1.6%, 1995-2011) at 4.2% compared to March 2011 (+4.3% in Top 23 dairy states). March was the eighth consecutive month milk production grew above trend increase. March production in Michigan increase 7.3% compared to March 2011. The size of the U.S. dairy herd grew by 12,000 head from February to March and is up 86,000 head compared with March 2011. Dairy cow slaughter numbers in 2011 ran well ahead of 2010, up 106,600 head, and are up in 2012 through March (+33,700 head). Average cull cow prices remain very strong in March at $84.50/cwt (+12.4% compared with March 2011). Milk production per cow in 2011 was below trend increase (+0.9%), however, it has rebounded and averaged +3.1% January through March, plus March marked the fourth consecutive month it grew above trend. USDA reported an increase in dairy feed prices in March of +22.1% compared with March 2011. March’s income over feed costs was down 35.7% (-$3.01/cwt) as compared with March 2011.

Demand: USDA reported all categories of wholesale dairy products showed above trend increases for 2011 commercial disappearance except fluid products. Total commercial disappearance for 2011 finished the year slightly below trend increase (+1.6%) at +1.5%. So far (January-February) 2012 is off to a weak start with total commercial disappearance at only +1.0% as compared with January-February 2011. January through February disappearance of individual product categories is: American cheese, +1.7%; other cheese, +1.9%; nonfat dry milk, +17.8%; butter, -2.1%; and fluid milk, -3.0%.

U.S. dairy trade has shown trade surpluses for twenty six consecutive months. February marked the twelfth consecutive month exports exceeded $400 million and the twenty third consecutive month exports equaled 12-15% of total U.S. milk solids production. February dairy exports equaled 12.6% of total U.S. milk solids production. Total solids exported in 2011 were up 7% over 2010 and up 49% over 2009. In 2011 one of every eight tanker loads of raw milk was ultimately exported. In CY-2011 exports accounted for 49% of nonfat dry milk/skim milk powder produced by the U.S., 4.7% of cheese, and 7.6% of butter.

Dairy Product Inventories: The latest USDA Cold Storage Report showed and inventory increase in March for American cheese (+1.8% at 621.9 million lbs.) and an inventory decrease for total cheese (-2.4% at 1,004.5 million lbs.) as compared with March 2011. March marked the first time in five months total cheese inventory was greater than 1.0 billion pounds. March butter inventory was 46.0% above March 2011 at 210.6 million pounds, marking the eighth consecutive month butter inventory was above the same month last year.

Outlook: Dairy fundamentals are growing increasingly bearish as national milk production January-March increased at +4.1% as compared with January-March 2011, the largest increases since early 2006. As one major dairy cooperative president aptly commented, the increase in milk production is producing a “recipe for a crisis.” The primary reasons for the production increase are the relatively warm weather, growth in cow numbers, and growth in milk per cow. It is also alarming that the U.S. dairy herd continues to steadily grow in size (+12,000 head February to March, +86,000 head as compared with March 2011) despite high cull rates (January-March; 34.7%, 4.3 percentage points above the January-March average). The consumer confidence index fell to 70.2 in March from 71.6 in February and remains far short of the 90 level which is indicative of a healthy economy. Also, total commercial disappearance finished below trend in 2011 and has started off 2012 well-below trend. American cheese inventory is now above last year while total cheese inventory is below last year but again in excess of 1.0 billion pounds. Butter inventory is very high. The block/barrel cheese price average was steady to higher over the past month despite these developments. However, CME Class III futures are mostly down since late March.

The Easter/Passover/Spring Break dairy product sales season is over so look for cheese prices to slide to the mid or low $1.40 range in the coming weeks. Cheese prices may even go below $1.40 for short periods. There may be some very brief rally points as wholesalers refill pipeline stocks and aging programs at the lower prices, but don’t look for cheese prices to rally more than $0.15/lb. Dry whey prices continue to fall. February’s dry whey price settled at 64¢/lb, but the futures market is now forecasting prices as low as of 40.5¢/lb by July 2012. This holds the potential to erode $1.41/cwt off Class III prices by then. Perhaps this is already factored into the Class III futures market, but regardless, dairy producers need to be aware of this important factor as they make forward pricing decisions. The current spot block/barrel cheese price ($1.4888/lb) is only adequate to sustain Class III futures prices of ~$14.32/cwt at average whey prices.

Overall the U.S. dairy export market remains strong at +26% as compared with 2011 levels and the biggest bright spot in our dairy industry. Exports should remain strong with the U.S. dollar remaining weak. Oceania is winding down their 2012 milk production season with milk output up (New Zealand, +10%; Australia, +4% as compared with 2011), but they continue to anticipate finishing this year’s milk production season with no significant uncommitted stocks of dairy products. The EU situation is less clear and they may have extra product to export. Current U.S. cheese and butter prices are above world prices, but U.S. nonfat dry milk is below world skim milk powder prices. Another wild card is India who was a net importer of skim milk powder in 2011, but of late has experienced a significant increases in milk production (+4.5%) resulting in very high skim milk powder inventory (100,000 tons) which, at least in part, may hit the world market. Also, a cloud remains over the export market due to the debt crisis concerns in many countries which could trigger another major worldwide recession. With uneven domestic dairy consumption, the current market is critically dependent upon maintaining high export volumes. USDA forecasters are bullish for continued growth in our export market and also believe domestic commercial disappearance will grow faster than population growth during the next decade due to increased “away-from-home” eating.

Even though cheese prices have held their own over the past month, there is still significant downside risk as shown by the erosion of Class III futures prices. Producers need to recalculate their cost of production and consider marketing milk. I expect milk production and cow numbers to continue increasing above trend. It is very disconcerting that March milk production grew at +4.2% and we gained 12,000 dairy cows in the national herd despite record dairy cow slaughter. As a president of a major dairy cooperative aptly commented, this is a “recipe for a crisis.” Thus, look for weakness in all dairy markets over the next two months. Feed prices continue to be quite strong, especially if you are looking to buy hay. Thus, if you are a dairy producer forward pricing milk, be sure to simultaneously lock in some feed. It is possible that feed prices might drop, but I believe there is much more upside than downside risk for feed prices.

Print

Print Email

Email